Contents:

The company may either call the whole amount or partially by way of ‘calls’. The company calls for money from shareholders when needed within a certain period. If the shareholder is not able to pay the call amount due on an allotment or on any calls according to the terms before or on the specific date fixed for payment, such amount is taken as ‘call in arrears’.

An authorized company can accept calls in advance from its shareholders but the amount of call in advance in the journal entry cannot be credited to the capital amount. Call in advance needs to be credited to the calls in the advance account. In this case, the amount which company has not received from the defaulter is debited to ‘Calls in arrears Account’.

The Structured Query Language comprises several different data types that allow it to store different types of information… Gasoline taxes are collected two months in arrears and expected to drop percent. Show the necessary journal entries to record the above transactions and show how these appear in Balance Sheet. Calls in advance is adjusted in future at the time of relevant call. A call auction is a trading method used in illiquid markets to determine security prices.

Legal Definition

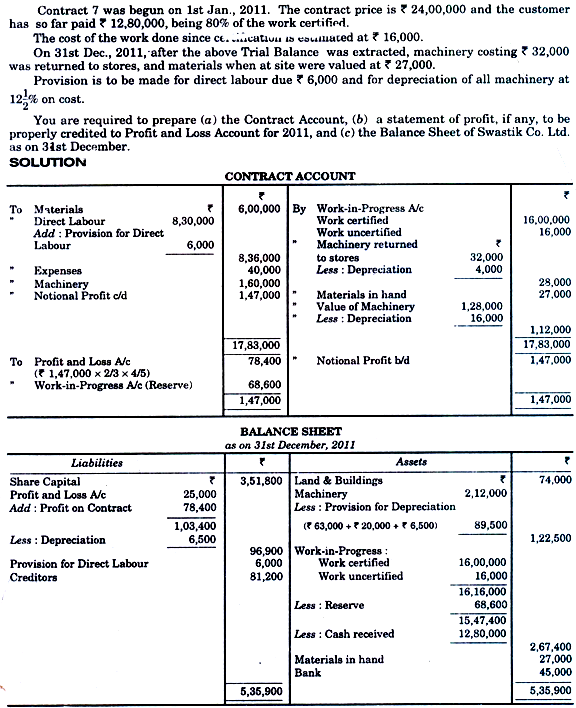

Tanya Ltd. issued 70,000 shares @ ₹10 each payable as ₹4 on Application , ₹3 on Allotment , and ₹3 on First and Final Call . Kashish was allotted 1,200 shares and he failed to pay the First & Final Call money on the due date. But he paid the unpaid first & final call money on 1st August 2021 with the interest of 10% p.a. A unit of capital or an equal portion of the share capital of an organisation divided, whose ownership is evidenced by a share certificate is known as a Share.

Plapoly casual workers demand payment of 26-month stipend arrears – SundiataPost

Plapoly casual workers demand payment of 26-month stipend arrears.

Posted: Mon, 27 Mar 2023 16:00:02 GMT [source]

Such amount may be called up by the Company either as Allotment Money or Call Money. Calls in arrears is shown in the liability side by deducting from the called up capital. If shares are forfeited, than it is deducted from share forfeited account. There are both advantages and disadvantages to paying in arrears. While it may make sense to utilize this option for tasks such as payroll, it may not be the best choice for paying certain bills or invoices.

Difference between Calls in Arrears and Calls in Advance

Noting that a certain bill is due on the first day of each month allows you to control your cash flow and make sure that you have the funds needed for payment. Most companies pay in arrears for both hourly and salaried employees, once it’s determined what they are owed for already completed work. It’s a helpful system for owners since paying in arrears gives them the time to factor in extra calculations such as overtime or tips before they run their final payroll numbers.

They do, however, fall into arreahttps://1investing.in/ if you don’t pay them by the due date. Being in arrears may or may not have a negative connotation depending on how the term is used. In some cases, such as bonds, arrears can refer to payments that are made at the end of a certain period. Similarly, mortgage interest is paid in arrears, meaning each monthly payment covers the principal and interest for the preceding month. If one or more payments have been missed where regular payments are contractually required, such as mortgage or rent payments and utility or telephone bills, the account is in arrears.

Hence, it appeawhat is call in arrears on the liabilities side of the balance sheet under the head Current Liabilities and subhead other current liabilities. When financing is demanded from shareholders on calls, the respective accounts are debited. There are certain situations in which some shareholders cannot pay their dues on the allotment and/or on calls within the stipulated time. The amount which is not paid by defaulter shareholders is termed as calls in arrears and it shows a debit balance. The opening of ‘calls in arrears account’ supports in preparing the balance sheet since it is deducted from called up capital. In this case, the amount which company has not received from the defaulter is debited to ‘Calls in arrears Account’.

The call account, in this case, shows the debit balance equal to the unpaid amount of the call. And when the unpaid amount is received, the Bank A/c is debited, and the relevant Call A/c is credited on that date. A company issues its shares in the market and the public purchases its shares.

What are Calls in Arrears & Advance | Meaning | Auditors Duty

If any failure or default arises to send the call money, it may be known as the calls in arrears. For the calls in arrears, a separate account should be opened and maintained. Calls in Arrears refers to the amount called by the company which is not paid by the shareholders before the due date fixed for the payment. Such amount is transferred to an account calls in arrears account from the call account. In a nutshell, calls in advance imply the uncalled-up amount received by the company from a shareholder in advance. On the other hand, calls in arrears represent the unpaid-up amount on shares which is due but not yet received.

- Articles of association may empower the directors to charge interest if the calls are not paid on due date.

- Calls in arrears is the non-payment of the amount due on allotment/calls by one or more shareholders.

- In any case, if the company is subjected to a loss then there is a huge risk of either losing a part of the shares or losing the whole of the shares, equity shares are not at all preferential.

- It may be noted that calls in arrears account has debit balance.

- The interest rate must be paid to the shareholders, even if the company is not profitable.

The directors decided to charge and allow interest, as the case may be, on calls in advance and calls in arrears. The directors made the allotment in full to applications demanding 10 or more shares, and they returned the money to applications for 6,000 shares. A company, if authorized by its articles, may accept calls in advance from shareholders. All money up to allotment was duly received, but regarding the call of $25, a shareholder holding 100 shares did not pay the amount due. The difference between called-up share capital and paid-up share capital is that investors have already paid in full for paid-up capital.

This use of arrears accounting indicates that payment will be made at the end of a certain period, rather than in advance. This means that the interest is due to be paid on the maturity date of the loan, instead of in bits and pieces during the life of the loan like an annuity payment. When an issuer makes $50 coupon payments semi-annually, this means the interest on the bond would have to accrue for six months before any payment is made to the bondholders. Arrears is a financial and legal term that refers to the status of payments in relation to their due dates. The word is most commonly used to describe an obligation or liability that has not received payment by its due date. Here, it is to be noted that, as per the Companies Act, 2013, a company can only accept calls in advance from a shareholder only if the company’s articles of association authorizes to do so.

Solved Example on Calls In Arrears and Calls In Advance The Indore Coir Mills Ltd. The amount is known as paid-up capital, and the charge of interest at 10% p.a is chargeable in the call of arrears. Though, it depends on the provision of the articles of the company itself. The company directors have the right to cut off or wave off the interest rate on arrears calls. When vendors agree to be paid in arrears, it becomes easier to create and stick to a budget, since you know in advance what amount is due and when.

Connect With a Financial Advisor

Thus, in case, any default on account of not sending the call money, is known as “CALLS-IN-ARREARS” and separate account i.e. However, the amount that is not called should not be credited to the capital account. A company may pay interest on such amounts received in advance at the rate of 6% p.a. When any shareholder fails to pay the amount due on allotment or on any of the calls, such amount is known as ‘Calls-in-Arrears’/‘Unpaid Calls’. Interest at a rate 10% shall have to be paid on Calls-in-arrears for the period from the day fixed for payment and the time of actual payment thereon.

Karnataka transport unions call off strike after govt agrees to 15% pay hike with arrears – News9 LIVE

Karnataka transport unions call off strike after govt agrees to 15% pay hike with arrears.

Posted: Mon, 20 Mar 2023 09:10:23 GMT [source]

Sometimes a shareholder pays a portion or whole on the unpaid amount on the shares held by him in advance. In such a case, money so received in advance is transferred to Calls-in- advance account. It is important to note that calls-in-advance does not form part of share capital. In-spite of this, according to Section 93 dividend may be paid on calls in advance, if authorized by the Articles.

The interest rate on the amount of call in arrears can be 10% maximum. However, the interest in calls in advance can be a maximum of 12%. Information provided on Forbes Advisor is for educational purposes only. Your financial situation is unique and the products and services we review may not be right for your circumstances. We do not offer financial advice, advisory or brokerage services, nor do we recommend or advise individuals or to buy or sell particular stocks or securities.

No dividend on calls in advance is given to the shareholder because it is not treated as a part of called-up capital. And the shareholder becomes liable to pay the entire sum due on the shares held by him/her. Share can be defined as a share in the share capital of the company which includes stocks. According to section 2, the company act 2013, a share capital can be divided into several units of smaller denominations. Eligible customers would receive a $25 monthly credit toward current water bills with any arrears suspended for one to two years. Or, your loan could be recalculated and the arrears added to the loan balance, which might make your monthly payments go up.

Leave a Reply